what is limited fsa health care

Designed only for submitting eligible dental and vision expenses the Limited Expense HCFSA is used as a replacement for the old good HCFSA when the participant owns a High Deductible Health Plan with an HSA. This is so because the IRS doesnt allow for the HSA.

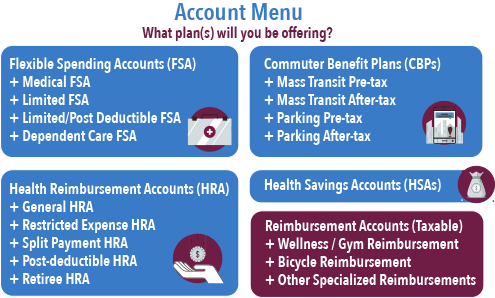

Five Questions To Implement A Pre Tax Benefit Plan Bri Benefit Resource

1 2022 the contribution limit for health FSAs will.

. Limited Purpose Health Care FSA FAQs. Limited Purpose FSAs can only be used for dental and vision expenses that employees health plans dont cover. Rates of heart disease and cancer are more than twice as high in the US.

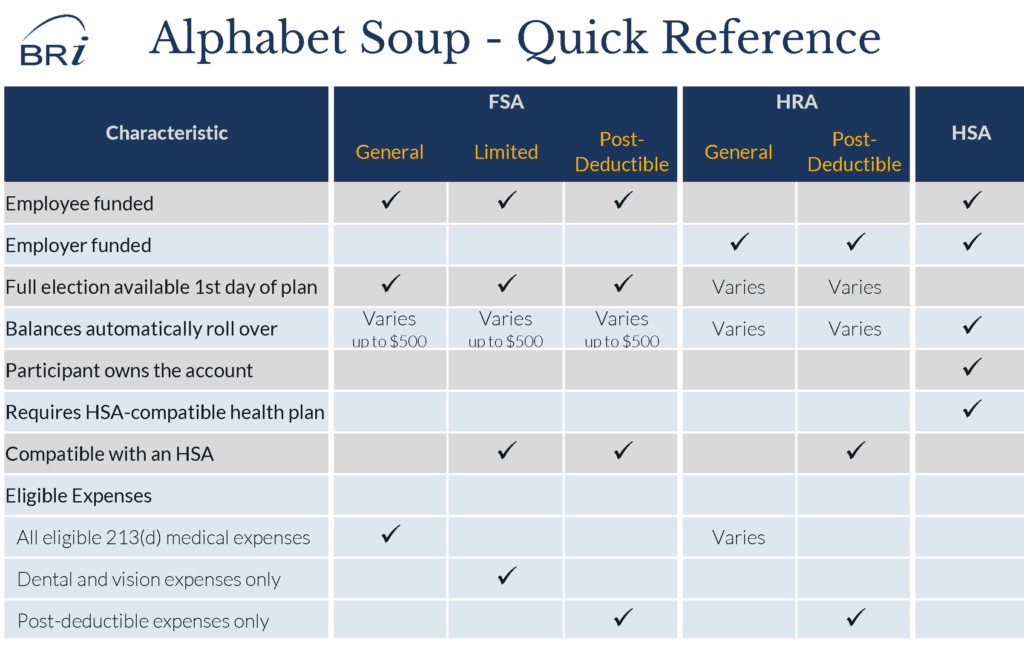

The method of funding. If youre enrolled in an HSA-qualified high-deductible health plan and have a Health Savings Account HSA you can increase your savings with a Limited Expense Health Care FSA LEX. An LPHC FSA is used to pay out-of-pocket dental and vision eligible expenses not covered by.

Americans consume so much health care in large part because they need it more. What is health care spending limited purpose. A Limited Healthcare FSA is a pre-tax benefit account that works with a Health Savings Account HSA allowing employees to set aside money to pay for qualified dental and vision expenses.

One big difference between the. Limited-Purpose FSA Eligible Expenses You can use your. Learn about FSAs flexible spending accounts how FSAs work what they are and how they may help you cover out-of-pocket medical expenses.

You can use funds in your FSA to pay for certain. A Limited Purpose FSA is a healthcare spending account that can only be used for eligible vision and dental expenses. Differences between a Health Care FSA a Limited Purpose FSA a Dependent Care FSA The coverage of eligible expenses.

A Limited Purpose FSA is a Flexible Spending Account FSA that is compatible with a Health Savings Account HSA. 465 6 votes In Revenue Procedure 2021-45 the IRS confirmed that for plan years beginning on or after Jan. A Limited Purpose FSA is similar to a Healthcare FSA in that it acts as a tax-advantaged spending account for health-related expenses.

FSAFEDS offers a Limited Expense Health Care Flexible Spending Account LEX HCFSA for eligible employees in FEHB high deductible health plans HDHP with a health savings account. The rules for these accounts are similar but not exactly. FSAs are limited to 2850 per year per employer.

What is a Limited Purpose Health Care FSA LPHC FSA. If youre married your spouse can put up to 2850 in an FSA with their employer too. As in Europe and the incidence of.

Only certain medical expenses are covered through a Limited. A Limited Purpose FSA is referred as this because it is used. A Limited FSA is often paired with an HSA.

A Limited Expense Flexible Spending Account also known as a limited purpose FSA is another type of pretax health account. A Limited Purpose FSA is a Flexible Spending Account FSA that is compatible with a Health Savings Account HSA. If youre enrolled in a qualified high-deductible health plan and have an.

To ensure that the individual remain eligible for an HSA a Limited FSA can be offered that only covers very specific items not covered under the. A limited-purpose flexible spending account LPFSA is a pretax account only available to employees enrolled in a qualified high-deductible healthcare plan HDHP. A Limited Purpose FSA is a Flexible Spending Account FSA that is compatible with a Health Savings Account HSA.

Understanding The Limited Purpose Fsa Datapath Administrative Services

Kiss Yoga Studio Great News If You Have A Fsa Or Hsa You Can Use The Tax Free Funds To Pay For It Read The Following To Find Out How How Can

The Perfect Recipe Hra Fsa And Hsa Benefit Options

Limited Purpose Fsa To Preserve Hsa Value Core Documents

Fsa Eligible Items Top Tips And What You Can Purchase At A Glance

Limited Purpose Fsa Lpfsa Optum Financial

Page 11 2022 Active Open Enrollment

Understanding The Year End Spending Rules For Your Health Account

Limited Purpose Fsas Combining Hsas And Fsas Infographic

Using A Limited Purpose Fsa In Conjunction With Your Hsa National Benefit Services

What Is A Health Care Flexible Spending Account Optum Financial

Benefit Marketing Solutions Llc Flexible Spending Account

Don T Wait Use Your Fsa Funds Before The End Of The Year Arkansas Department Of Transformation And Shared Services

Flexible Spending Accounts Fsas Workday